Saudi Aramco is set for a major offshore investment as it plans to build a $10-billion refining and petrochemical complex in China over the next three years, taking advantage of the country’s growing demand for energy.

The complex will have a capacity of 300,000 barrels of crude daily, Aramco said in a news release. The Saudi major will supply 201,000 barrels per day to the facility.

The project will be carried out in partnership between Aramco and two Chinese companies. Construction works should begin in the second half of this year, with the project scheduled for completion in 2026.

“This important project will support China’s growing demand across fuel and chemical products. It also represents a major milestone in our ongoing downstream expansion strategy in China and the wider region, which is an increasingly significant driver of global petrochemical demand,” said Aramco’s head of downstream, Mohammed Al Qahtani.

The news follows another report from December last year, that said Aramco had struck a deal with China’s Sinopec to build a 320,000-bpd refinery and petrochemical cracker in China, highlighting the latter’s major role in global oil consumption yet again.

Refining and petrochemical investments have been a priority for Aramco as it seeks to secure long-term demand for its main product, even as it expands local refining capacity as well.

According to the International Energy Agency and other forecasters, a bet on petrochemicals is a good long-term bet in the oil industry amid expectations of a decline in oil demand for transport fuels.

Indeed, the IEA has projected that petrochemicals will account for more than a third in oil demand growth by 2030, rising to 50 per cent of demand by 2050 as transport electrifies.

If the expected global transport electrification does not take place on the expected scale, however, this higher demand for petrochemicals will simply be added to total oil demand, including for transport fuels.

China is the most obvious destination for new petrochemical projects: the country is the world’s largest crude oil importer and one of the top three consumers of the commodity.

SINGAPORE (ICIS)–Saudi Aramco and its China-based joint venture partners are building a refinery and petrochemical complex at Panjin in Liaoning province which is expected to start full operations in 2026, the energy giant said on Sunday.

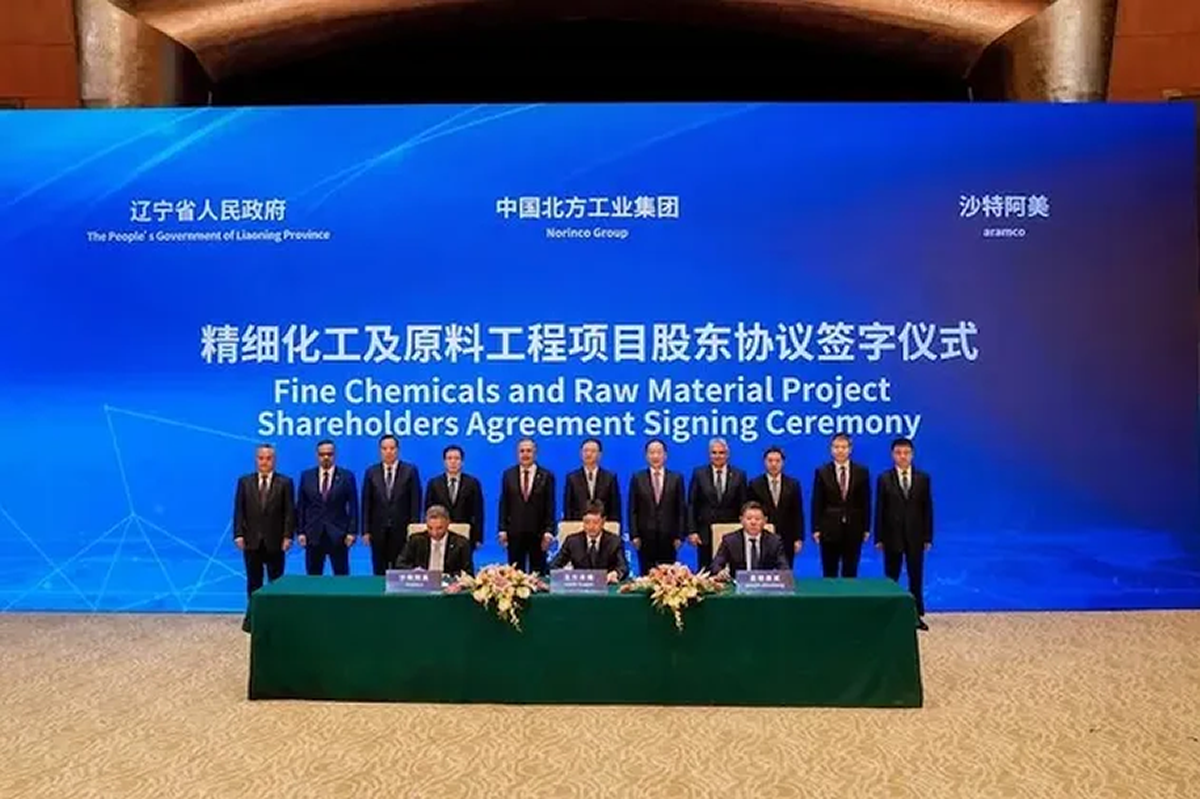

Huajin Aramco Petrochemical Company (HAPCO), a joint venture between Aramco, NORINCO Group and Panjin Xincheng Industrial Group, is developing the complex.

The new complex will combine a 300,000 bbl/day refinery and a petrochemical plant with an annual production capacity of 1.65m tonnes of ethylene and 2m tonnes of paraxylene (PX), it said in a statement.

Saudi Aramco earlier in 2019 said that the project was expected to cost more than $10bn.

Construction is due to start in the second quarter of 2023 after the project secures the required administrative approvals, Aramco said.

Aramco will supply up to 210,000 bbl/day of crude oil feedstock to the complex.

“The project is of great significance for Panjin to promote reducing oil and increasing chemicals and specialty products, strengthening integration of the refining and chemical industry,” said Jia Fei, the chairman of Panjin Xincheng.

“It is a symbolic project for Panjin as it seeks to accelerate the development of an important national petrochemical and fine chemical industry base,” he said.

State-owned Chinese military equipment producer NORINCO group owns a 51% stake in HAPCO, while Aramco and Panjin Xincheng Industrial Group hold 30% and 19% stakes in the firm respectively.

Saudi Aramco intends to construct a $10 billion integrated refinery and petrochemical complex in northeast China in the second quarter of 2023, it announced on Sunday.

The Huajin Aramco Petrochemical Company (Hapco) joint venture is developing the complex, which will combine a 300,000 barrels per day (bpd) refinery and a petrochemical plant with an annual production capacity of 1.65 million metric tons of ethylene and 2 million metric tons of paraxylene.

Aramco owns 30 percent of the joint venture, while Chinese firms Norinco Group and Panjin Xincheng Industrial Group hold 51 percent and 19 percent, respectively, the Saudi-listed company said in a statement.

The project is expected to be fully operational by 2026.

Aramco will supply up to 210,000 bpd of crude oil feedstock to the complex in Panjin, Liaoning province.

Mohammed Y. Al Qahtani, executive vice president of downstream, Aramco, said: “This important project will support China’s growing demand across fuel and chemical products. It also represents a major milestone in our ongoing downstream expansion strategy in China and the wider region, which is an increasingly significant driver of global petrochemical demand.“

In February 2019, Aramco signed an agreement to form a joint venture with Norinco and Panjin Sincen to develop a fully integrated refining and petrochemical complex in Panjin at the cost of $10 billion. The expected date of operation was then stated was 2024.

Gistfox Your News Window To The World.

Gistfox Your News Window To The World.