Atiku said President Tinubu has failed to show any convincing policy moves his government is making to arrest volatility in the currency market and tackle Nigeria’s endemic poverty.

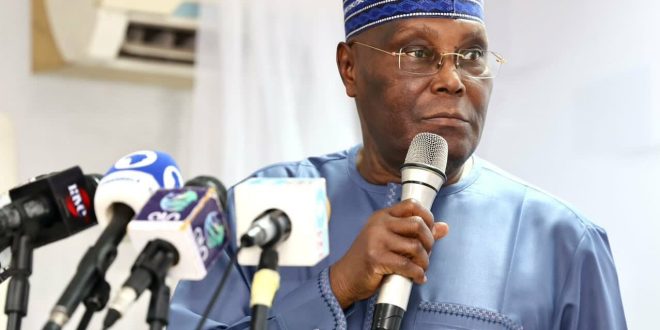

The presidential candidate of the Peoples Democratic Party (PDP) in the 2023 general elections, Atiku Abubakar, on Sunday, said he would have encouraged the Central Bank of Nigeria (CBN) to adopt “a gradualist approach to FX management”.

In an X post on Sunday, Atiku made grand recommendations for turning the economy around, while referencing a Thursday meeting with President Bola Tinubu.

He explained that the move would have been a panacea to curbing the free fall in the value of the naira against the dollar if he had been elected as the country’s president.

“Given Nigeria’s underlying economic conditions, adopting a floating exchange rate system would be an overkill,” he said.

“A managed-floating system would have been a preferred option. In simple terms, in such a system, the Naira may fluctuate daily, but the CBN will step in to control and stabilize its value. Such control will be exercised judiciously and responsibly, especially to curve speculative activities.”

The Nigerian government last June collapsed the country’s multiple naira exchange rates into a single window as part of several reforms aimed at allowing the local currency to float and courting overseas investors.

But most of the measures have come at great pain to individuals and corporations alike, forcing many import-dependent businesses to fold up or keep running at a loss. Multinationals including GSK and P&G are exiting the economy, citing overwhelming losses incurred from foreign exchange transactions.

Last year, the naira plunged by roughly half its value against the dollar as supply failed to keep pace with demand from currency users, making the currency one of the world’s worst-performing currencies by Bloomberg’s estimate.

Atiku said President Tinubu has failed to show any convincing policy moves his government is making to arrest volatility in the currency market and tackle Nigeria’s endemic poverty.

He disclosed that, were he to be the president, he would encourage the CBN to occasionally intervene in the foreign exchange market and stabilise the naira because Nigeria has inadequate, erratic and precarious foreign reserves to support a free-floating rate regime.

“Nigeria’s reserves did not have enough foreign exchange that can be sold freely at fair market prices during crises,” said Atiku, who was Nigeria’s vice president from 1999 to 2007.

He mentioned Nigeria’s inability to attract foreign investment in considerable measures and its inability to grow oil receipts on account of declining output as more grounds for it to explore a “controlled” foreign exchange system.

In the week to 2 February, the naira fell by 36 per cent after the CBN allowed an overhaul of the procedure for determining its rate in the foreign exchange market, narrowing the gap between the official exchange rate and the one used by traders on the street.

“Tinubu’s new policy FX management policy was hurriedly put together without proper plans and consultations with stakeholders. The government failed to anticipate or downplay the potential and real negative consequences of its actions,” Atiku said.

Gistfox Your News Window To The World

Gistfox Your News Window To The World