Nigeria Is Broke Can’t Fund 2023 Capital Project, Minister Admits

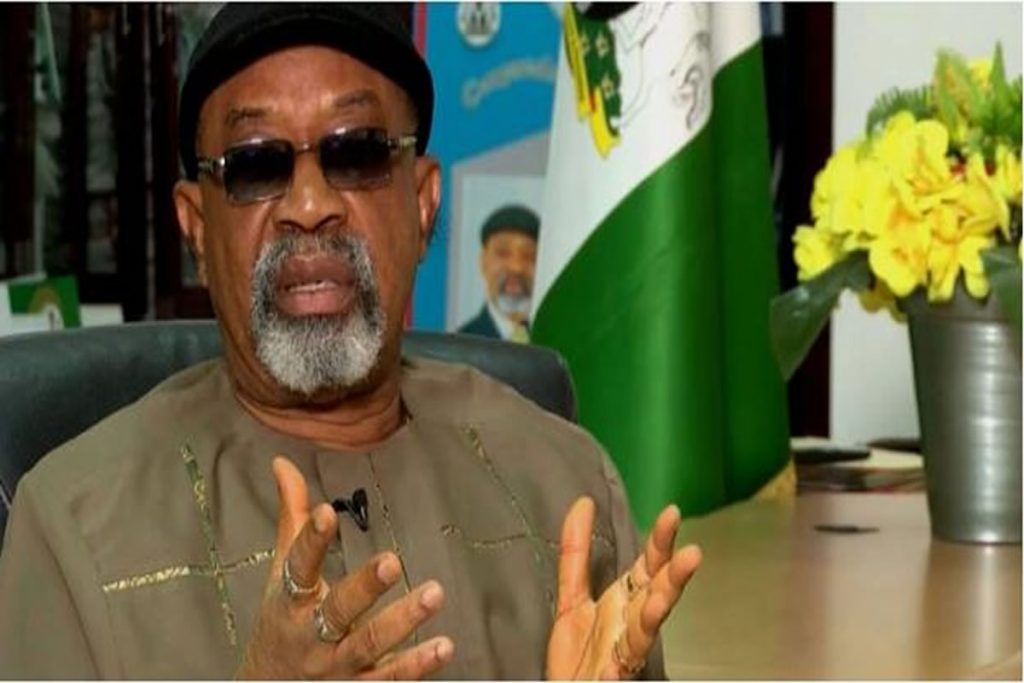

Nigeria’s Minister of Labour and Employment, Dr. Chris Ngige.

According to him: “I can tell you that Nigeria is broke. There is no money to fund capital projects next year. As you can see, the dollar that has been hovering around N500 and N600 is now above N700. The truth is that there is no money anywhere. The money that the FAAC (Federation Account Allocation Committee) has been sharing is money from taxes, customs and other revenue-generating agencies.

“The National Nigerian Petroleum Company Limited (NNPC) no longer remits money to FAAC.

“Without removal of oil subsidy, petroleum subsidy, we will have a zero capital budget for 2023. That is the truth of the matter.

“And without capital projects, it means that your economy will lie prostrate on the ground because it is the capital project expenditure that gingers our economy, that puts money directly into production. Every other money you put in recurrent is for consumption; it doesn’t create jobs.

“We need to create jobs with capital expenditure. These are ominous signs; they are red flags. We will have to assist the country and ourselves by asking ourselves: shall we continue to do what we are doing now?

“So, the situation calls for patriotism from all Nigerians. The lack of money to fund capital projects would have implication on capacity to create jobs. If jobs are not created, poverty will increase in the country.”

What you should know

Ngige’s confession is in sharp contrast with an earlier statement made by his counterpart in the Ministry of Works and Housing, Babatunde Fashola.

Fashola on Sunday said Nigeria is not broke, stressing that “being in debt and being able to service your debt in conventional finance is not being broke.”

Gistfoxnews reports that Africa’s most populous country appears to be spending more than it earns. A little over 6 trillion of Nigeria’s 17 trillion naira 2022 budget is to be funded by debt. The bulk of expenditure in the budget is ironically debt servicing and other recurrent expenditures.

What’s more, Nigeria is adding about 3 trillion naira to the budget to finance fuel subsidy, a move that spells more increase in debt for the nation which currently services existing debt with over 100% of generated revenue.

Essentially, Nigeria is borrowing to service existing debt, borrowing to finance fuel subsidy, borrowing to pay salaries and overheads and of course, a tiny portion to finance infrastructure.

In addition to these disastrous trends, the value of the naira is on a free fall, not surprising given that the country is not very productive with a large army of unemployed citizens constituting 33% while the underemployed make up 22.8% of the nation’s population.

More damning indices

States in Nigeria are in dire straits and desperately looking for means to pay salaries and cover budget expenses amid dwindling allocation from the federation account.

The revenue allocation to federal, state and local governments declined from a peak of N970.57bn in July 2021 to N680.783bn in May 2022, representing a 30 per cent reduction over the period.

The decrease in allocation to these levels of government reveals the fiscal challenges facing various levels of government in Africa’s biggest economy.

Nigeria earns its biggest revenue from crude oil, but it has paid N2.1tn in the first six months of the year and could pay another N4tn by the end of the year, according to the International Monetary Fund estimates.

The situation is worsened by declining oil production and theft. Oil production fell to 1.2 million barrels per day in April 2022 from 1.238 million barrels in March, according to OPEC Monthly Oil Market Report.

This is far from the oil benchmark of 1.88 million barrels per day in the 2022 budget.

Latest data from the Central bank of Nigeria also showed that States debts have increased to N1.24 trillion from just over N14 billion in April 2016.